Bitcoin, the flagship cryptocurrency, is experiencing a notable shift in investor behavior as long-time holders steadily withdraw their positions, contributing to renewed downward pressure on prices. More than two months after the token reached a record high above $126,000, its value has slid nearly 30 %, and it is struggling to find stable support levels.

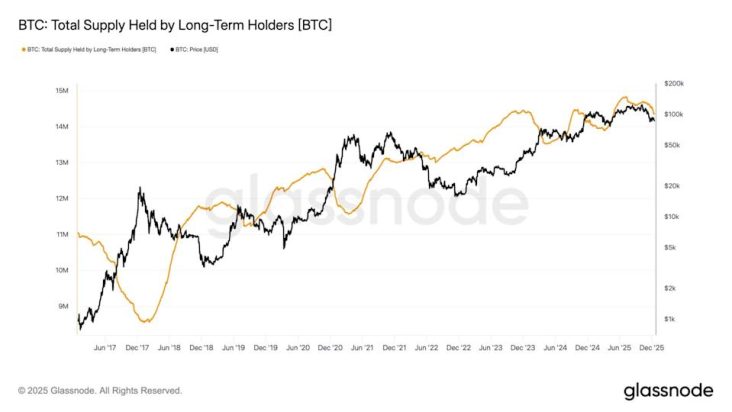

Blockchain data reveals that coins held for years by entrenched investors are increasingly being sold, suggesting profit-taking is occurring at some of the fastest rates observed in recent memory. As a result, the supply of Bitcoin re-entering circulation has risen sharply, while the market’s ability to absorb these sales has diminished.

This so-called “silent exodus” comes amid fading demand from key segments of the market that earlier helped sustain the rally. Inflows into Bitcoin investment products such as ETFs have turned negative, derivatives trading activity has cooled, and retail participation has thinned—leaving steady spot selling to exert a more significant influence on prices.

Analysts note that long-term holders have been willing to realize profits at elevated price levels, while new buying interest is less robust than during the recent peak. With fewer active buyers in the market, these organised exits have contributed to a grinding price decline rather than a sharp correction driven by leverage.

As Bitcoin navigates this period of recalibration, the balance between selling pressure and renewed accumulation will be crucial in determining whether it can reclaim upward momentum—or settle into a prolonged range of consolidation.