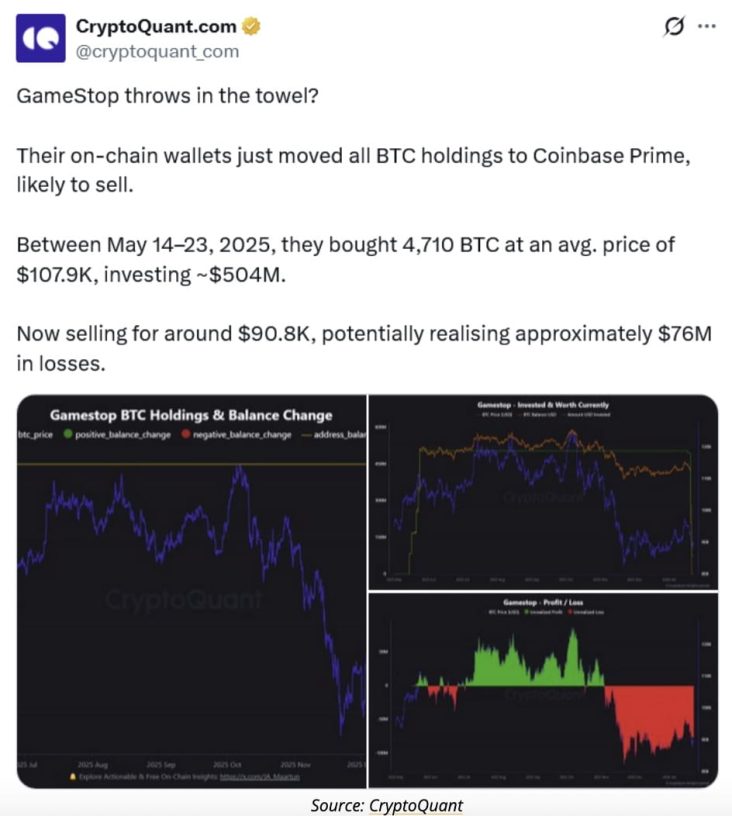

GameStop has moved its entire Bitcoin treasury to Coinbase Prime, an institutional-grade crypto platform, triggering widespread discussion and speculation within the crypto community. The transfer involves 4,710 BTC, marking a significant on-chain movement by one of the most talked-about corporate Bitcoin holders.

Such large transfers often attract attention because moving funds from long-term custody wallets to an exchange-associated platform is commonly viewed as a preparatory step for selling. This has led many traders to question whether GameStop is considering liquidating its Bitcoin holdings amid ongoing market volatility.

The company initially acquired Bitcoin in 2025 as part of a broader treasury diversification strategy. However, with Bitcoin trading below GameStop’s average purchase price, any immediate sale could result in substantial unrealized losses. This context has intensified debate over whether the move reflects risk management, a strategic restructuring, or a potential exit from its Bitcoin position.

Despite the speculation, transferring assets to Coinbase Prime does not automatically mean a sale is imminent. The platform also offers services such as secure custody, portfolio rebalancing, and collateral management, suggesting the move could simply be operational rather than directional.

GameStop has not issued an official statement clarifying the intent behind the transfer. Until further disclosure or additional on-chain activity emerges, the market remains divided on whether this signals a bearish move or a routine treasury adjustment.