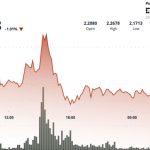

Bitcoin surged to approximately $106,160 today, recording a 4% daily increase and signaling renewed momentum in the broader cryptocurrency market. The rise comes at a time when global crypto market capitalization has expanded to $3.57 trillion, driven by growing institutional participation, improved investor sentiment, and increasing interest in digital assets as a hedge against macroeconomic uncertainty.

Market analysts suggest that multiple factors are contributing to Bitcoin’s upward movement. First, institutional funds and large-scale asset managers are continued buyers, especially following recent approvals of Bitcoin-based financial products in major markets. This wave of structured institutional inflows adds strong liquidity and reduces volatility in the asset, creating a more sustainable market environment.

Second, macroeconomic conditions appear supportive. Expectations of a potential shift in federal monetary policy, including possible interest rate adjustments, are pushing investors toward store-of-value assets. Bitcoin, often viewed as “digital gold,” benefits significantly in such environments where currency stability and inflation hedging become priority considerations for diversified portfolios.

Additionally, Bitcoin’s supply dynamics continue to play a crucial role. With the next halving cycle already priced into market strategies and miners optimizing operational efficiency, supply reduction pressures are gradually influencing long-term price support. Demand remains strong, especially from retail investors and corporate treasuries looking for yield alternatives and high-performance asset allocation strategies.

The broader crypto market is echoing Bitcoin’s trajectory. Altcoins across decentralized finance, AI-driven blockchain protocols, and large Layer-1 networks have shown price increases in tandem, suggesting healthy sector-wide participation rather than isolated speculative behavior.

While some analysts caution that short-term price corrections remain possible, the current momentum indicates that Bitcoin may be preparing to challenge previous peaks if market conditions maintain their upward trend. With institutional adoption rising and macroeconomic signals tilting favorable, Bitcoin appears well-positioned to continue its role as the leading asset in the evolving digital financial landscape.